Home Warranty and Homeowner’s Insurance Policy – what’s the difference? Purchasing a home is typically one of the most significant investments that someone makes. A home purchase is often an exciting time, but the cost of repairs is not considered. A home warranty and homeowner’s insurance policy can alleviate the cost of home repairs, but most do not understand the difference between these two policies.

What is a Home Warranty Policy?

A Home Warranty Policy is not a legal warranty, like a manufacturer’s warranty, or insurance that covers a loss. A Home Warranty Policy is an annually prepaid residential service contract that reduces or eliminates costs for future home repairs. In some cases, the Home Warranty will cover the cost to replace an appliance that is deemed unfixable. A Home Warranty Policy covers washing machines, clothes dryers, refrigerators, ovens, trash compactors, garbage disposals, dishwashers, and HVAC systems. Home Warranty Policies are optional and not required, unlike a Homeowner’s Insurance Policy. A Homeowner’s Warranty Policy covers a specific appliance with a policy expiration date. An example of what a warranty policy includes is when an oven stops working due to a malfunction within the oven – the warranty policy would cover this.

A Home Warranty Policy does not have to be purchased at the same time as when your home is bought – it can be purchased afterward. Although a Home Warranty Policy is not required, real estate agents will sometimes offer these as an incentive to buy a home. Real estate agents advise those that are selling their home to purchase a home warranty to protect against being sued by the new homebuyers if an appliance or system malfunctions after the sale is complete. Home Warranty Policies have a set limit amount for what is covered, and once that set amount is met, the warranty company will no longer pay for services or replacements. Typically a warranty’s yearly renewal cost is $300 – $600 on average for the basic plan, and the service fees are generally $50 – $75 per job.

What is a Homeowner’s Insurance Policy?

A Homeowner’s Insurance Policy is required by the bank that is financing the home. A Homeowner’s Insurance Policy covers loss to a home or property as a result of an unexpected event such as a fire, natural disaster, wind damage, hail damage, hurricane, tornado, or theft. The policy protects the exterior, interior, personal belongings, and structural damage to a home or property. Typically a Homeowner’s Insurance Policy costs $1,000 or more annually, and a deductible amount has to be paid when a claim is covered. Homeowner’s Insurance does not cover appliance repairs or replacements.

Coverage of a Homeowner’s Insurance Policy will contain replacement or repair of a home appliance that is damaged due to events like floods, fires, or storms. Unlike a Home Warranty Policy, a Homeowner’s Insurance does not cover maintenance issues or regular wear and tear problems. Generally, a Homeowner’s Policy has an exclusion regarding the wear and tear of appliances.

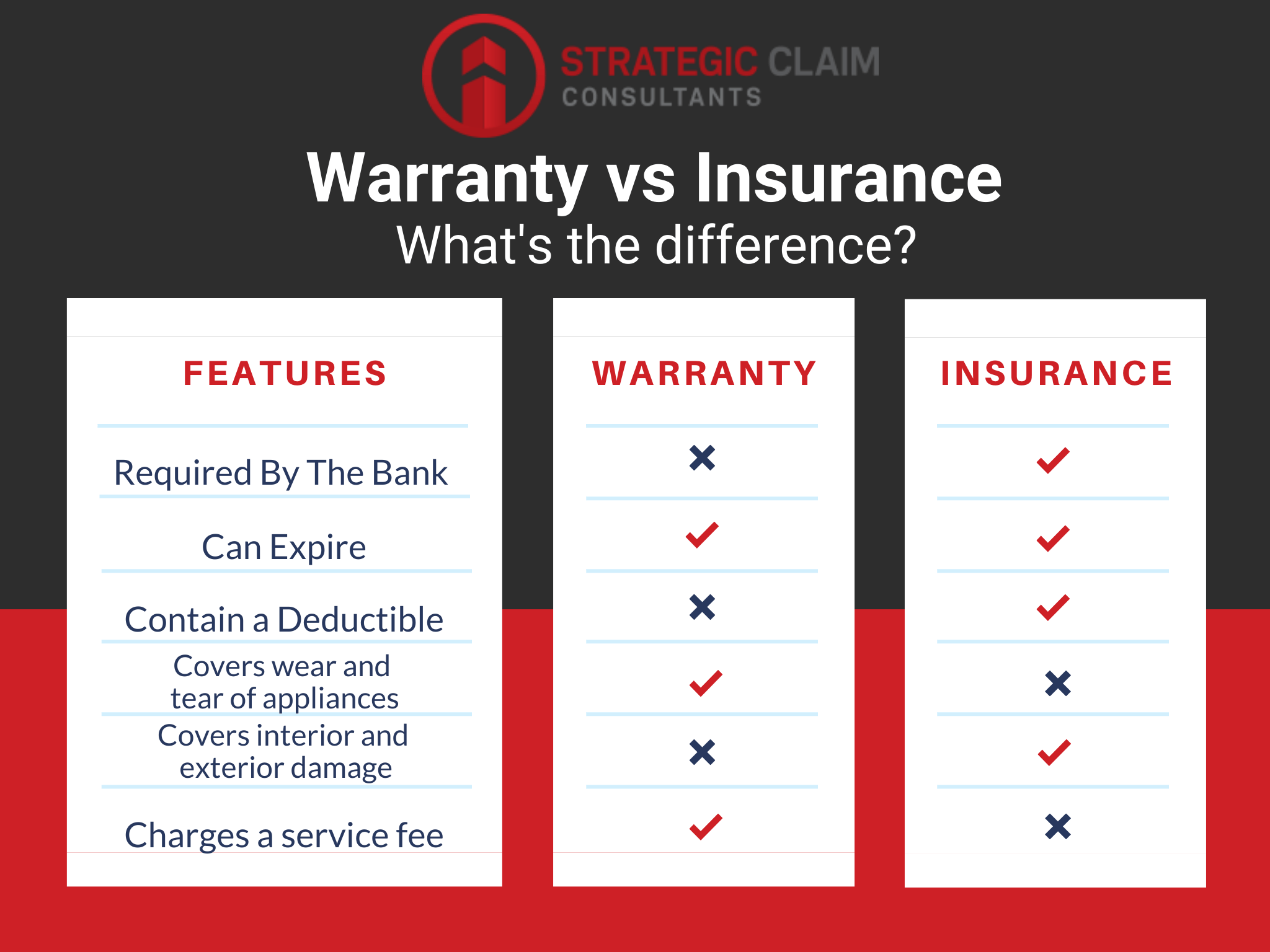

Review the comparison chart below with the key features of each policy type.

As leading commercial and residential public adjusters in Georgia, the team at Strategic Claim Consultants are experts in settling catastrophic claims quickly. We are not insurance agents. Should you need insurance, we recommend contacting a broker or agent to help with your needs. And one of the most common mistakes we see our clients make is simple and easy to avoid – failing to review insurance policies regularly. So, when is the best time to review your homeowner’s insurance policies?

If you have catastrophic damage to your home or office, your very next step should be to call a certified public adjuster. Strategic Claim Consultants, led by CEO Brandon Lewis, is located in Georgia but represents clients all over the US including Puerto Rico. The best way to get started is to contact us today.