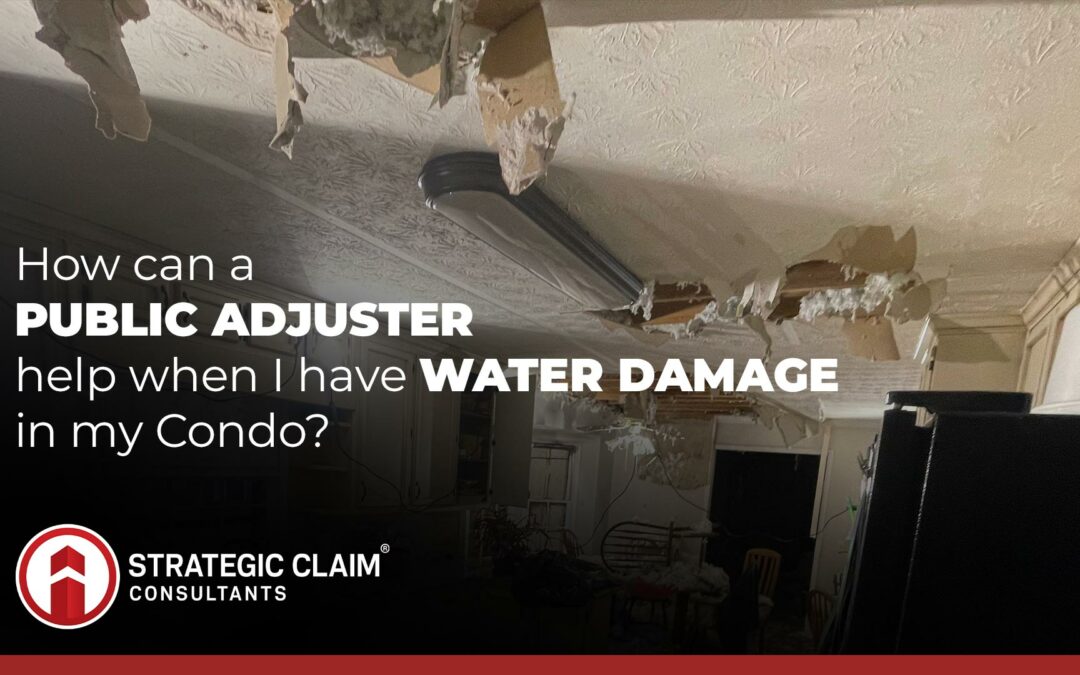

Water damage is one of the most common property damage types, especially for condos. Examples of damage that occur from water include pipe breaks, AC leaks, and shower leaks. This type of property damage can affect homes, condos, and commercial properties – but what if the damage source is not your property? This is a significant concern for condo owners. The condo location presents the possibility of filing a water damage claim due to damage from the condo above yours. As a condo owner, there is a chance that you will come home to a leak in the ceiling. If this happens, here are the next steps we recommend taking.

Locate the water damage source

Once you are aware of the issue, it’s important to pinpoint the water damage source and directly inform the condo owner. Given the potential for rapid escalation of the water damage, we recommend notifying your upstairs neighbor immediately.

Stop further water damage

To reduce the amount of damage done to your property and the upstairs property, it’s essential to communicate to the owner the significance of using these emergency tips:

- Remove excess water from the unit: Excess water could cause mold damage to the property. Strategic Claim Consultants is a dependable restoration company specializing in water remediation and can quickly remove water from the property.

- Shut off breakers, if applicable, before removing any electronic devices.

- Remove valuables from the damaged area but don’t dispose of the content.

- A Quick Safety Tip: Don’t use a dry vacuum to clean up the water or electrical appliances while standing on wet surfaces – especially concrete.

Review your insurance policies and condo laws

The next step in this process is examining your insurance policies to see what exactly would be covered. But before you can do this, it’s important to distinguish which individual is accountable for the damages. In this example, the water leaking from your ceiling was coming from a toilet leak in a bathroom in the upstairs condo. Who is responsible for the damages? Which party should file the insurance claim? Even if the claim seems obvious, it still depends on your condo and the condo association.

In Florida specifically, there’s a condo insurance law that covers this. The Florida Statute Section 718.111(11) deals with condo associations and their insurance policies. Under this law, the condo association is obligated to repair any part of the condominium property insured by the association and damaged by an insurable event.

This law also says,

“the coverage must exclude all personal property within the unit…appliances, water heaters, water filters…or replacements of any of the foregoing which are located within the boundaries of the unit and serve only such unit. Such property and any insurance thereupon is the responsibility of the unit owner.”

Consult with a public adjuster

Once the party responsible is determined, a claim needs to be filed. After a claim has been filed, we recommend calling a public adjuster to help with this claims process. When contacting the public adjuster, it is vital to have all the critical information. This critical information includes:

- Name of insured, address, phone number, e-mail, and policy number

- Description of loss: Time and date of loss, location of the incident, detailed description of damages

- Authority notification: Please note all authorities notified (fire dept., police, etc.)

- Emergency Service Companies & Damage Mitigation: Let them know if you have already contacted any emergency service companies or performed any sort of damage mitigation.

Contacting an expert public adjusting firm with water damage experience is what we recommend. An experienced public adjusting firm like Strategic Claim Consultants, led by Brandon Lewis, has the knowledge that allows them to reveal possible damage, both current and long-term. Working with a reputable public adjusting firm ensures that the policyholder receives the maximum payout.